You’d think a €32,000 salary would open the same doors everywhere in Europe. But in reality, those five digits on your contract are just the beginning of a much bigger—and sometimes wildly confusing—story. As someone who’s always been curious about what “gross” and “net” really mean on a payslip, I decided to dig a little deeper.

The results? Honestly, prepare to be surprised.

The Problem With “Gross Salary” – Why It’s Just the Tip of the Iceberg

It’s easy to assume that if two people in different countries are offered the same gross annual salary, they’d end up living similar lives. But Europe doesn’t work that way. Every country puts its own spin on taxes, social contributions, and mandatory deductions. That means the money you actually take home can swing dramatically—sometimes by thousands of euros a year.

And for employers, it’s just as wild. The total cost to hire someone can be way higher than what you see as gross on your contract. So if you’re job hunting abroad or running a business with staff across borders, ignoring these differences is a one-way ticket to confusion.

Let’s Talk Numbers: How the Same Salary Looks So Different

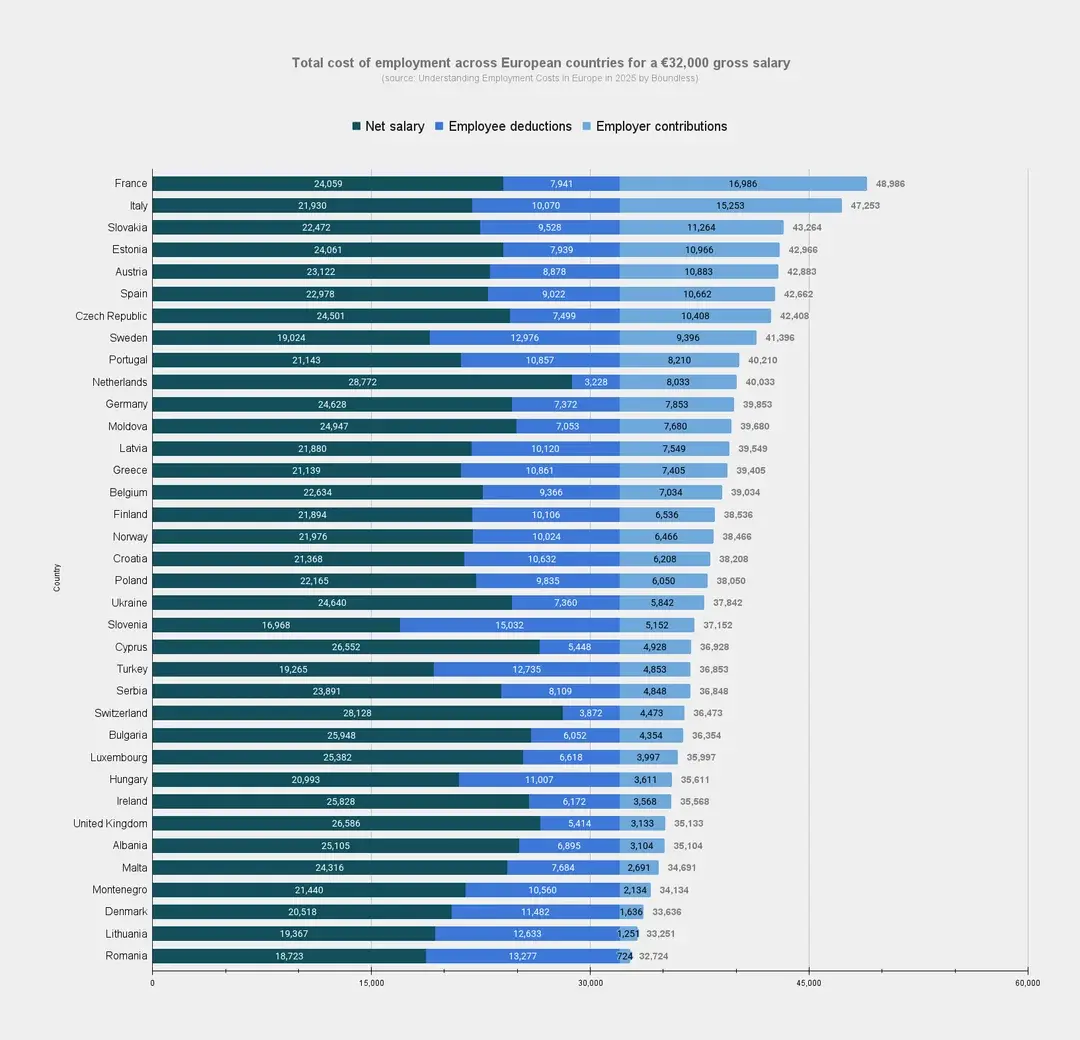

Imagine you’re looking at a colorful chart (like the one above) that breaks down net salary, employee deductions, and employer contributions for a fixed €32,000 gross salary in over 30 European countries. Sounds straightforward? Just wait.

The most expensive place for an employer is France. To give someone a net salary of €24,959 a year, a French employer actually shells out a whopping €48,986. Italy is right behind, with total costs over €47,000 and a take-home pay of just €21,390.

Slovakia, Estonia, Austria, Spain, and the Czech Republic all sit in the €42,000–€44,000 cost range, but the net pay bounces between €22,472 and €24,501.

That’s the same “gross” salary on paper, but what lands in your bank account—and what your employer pays for you—are two totally different realities. In the Czech Republic, for instance, €24,501 is what you’ll see after taxes and contributions.

Net vs. Gross: The Great European Deduction Mystery

So where does all that money go? The gap between gross and net is eaten up by employee deductions (think income tax, social and health insurance) and employer contributions (the company’s share for social security, healthcare, unemployment, and more). In places like France, employer contributions alone are nearly €17,000 a year—more than half your net pay!

In Italy, the deductions are even higher than the net salary. Meanwhile, countries like Romania, Lithuania, and Denmark keep the total cost much lower. For example, in Romania, a €32,000 gross salary only costs an employer €32,724. The trade-off? Lower net pay, with most contributions coming out of your side.

Pro TIP:

No matter where you live or work in Europe, always use a reliable VPN when browsing online. It keeps your personal salary details, banking, and job searches safe from prying eyes—especially on public WiFi.

| My 5 Best VPN | Offer + Discount | URL |

|---|---|---|

| NordVPN | 77% off + 3 months free | Try NordVPN |

| ExpressVPN | 61% off + 6 months free | Try ExpressVPN |

| SurfShark | 87% off + 2 months free | Try SurfShark |

| CyberGhost | 83% off + 2 months free | Try CyberGhost |

| PIA VPN | 82% off + 2 months free | Try PIA VPN |

Winners, Losers, and the Real Takeaway

If your goal is the highest possible net salary with the least deduction drama, you might want to move to Switzerland, Bulgaria, Luxembourg, or Ireland—these countries offer the best balance between net income and total employer costs. On the other end of the spectrum, countries like France, Italy, and Slovenia are where taxes and social charges can really eat into your pay.

But don’t forget: high contributions usually buy you better social security, health coverage, pensions, or unemployment benefits. That’s often why the West pays more in, while in some Eastern European countries, you’ll need to save more on your own.

Why Employers Care—And Where’s the “Tax Paradise”?

If you’re running a company and want the lowest staff costs, Romania, Bulgaria, Malta, and Albania are pretty hard to beat—total costs per employee are far lower than in Western Europe. That’s why you’ll find so many call centers, IT hubs, and back offices there. In Germany, Sweden, or Italy, companies need to set aside much larger budgets for staff on the exact same salary.

What Affects Your Take-Home Pay? It’s More Than Just Numbers

There’s a catch to all those neat graphs and charts: every comparison has its quirks. The numbers might not include bonuses, local tax perks, regional differences, or special deductions for parents or people with disabilities. Not to mention, the real cost of living can turn a decent salary into just-getting-by (or vice versa).

For some countries (hello, Slovenia, Sweden, Portugal), the chart data is a bit outdated or simplified, missing out on real bonuses or local variations. So always take these comparisons with a grain of salt—they’re a great start, but never the full story.

Handy Tips Before Accepting That Offer

If you’re eyeing a job abroad or even just curious, here’s what you really need to check:

- How much will actually land in your bank account after all deductions?

- What does it cost your future employer in total?

- What’s included in social security—health, pension, sick leave, unemployment?

- How do local living costs compare in your city or region?

Online salary calculators can help you figure out not just net pay, but also how much real-life “power” that money has in your chosen country. Because a big paycheck doesn’t mean much if rent and groceries eat it up in a flash.

The Bottom Line: “Same Salary” in Europe Is Just the Beginning

When you look at the numbers, it’s obvious: a so-called “equal salary” in Europe is anything but equal. What matters most for employees is net pay. For companies, it’s total cost. And in between, there’s a maze of deductions, contributions, and benefits that can make—or break—your bank account.

So next time you see a tempting job offer or salary chart, dig deeper. The devil really is in the details, and sometimes those little lines at the bottom of your payslip tell the real story.